There's two of us.

We get paid different amounts on different days. We share bills. Who's paying for what and when?

A Pragmatic System for Couples Who Share Bills

Cobalance helps two people coordinate fair per paycheck deposits to a shared bills account and verifies the future balance remains solvent.

Peace doesn't require tracking every dollar or a budget.

Set up in 10 minutes. Know the bills are covered and what's left for you.

THE PROBLEM

We get paid different amounts on different days. We share bills. Who's paying for what and when?

If combined, we gain simplicity but at the cost of our independence. If separate, we have to track who owes who.

We could keep a large buffer in the joint account for peace of mind, but that would tie up cash. We could put everything on the credit card, but that leads to extra spending and fees

THE SOLUTION

Agree on how to fairly split recurring expenses. Transfer your share to the bills account each check. Cobalance forecasts future cash flow. When income or expenses vary, know when you're covered, or have time to react when you're not.

A checking account designated exclusively for recurring bills.

Your shared bills, their due dates, and how often each partner gets paid.

Cobalance totals your shared bills, assigns each partner's share, then divides that share across their paychecks.

Contribution per paycheck = partner's share of yearly bills ÷ number of paychecks per year.

With the model in place, Cobalance will deterministically forecast your bills account for the next 12 months and show, for each paycheck, how much goes to bills and how much is truly safe to spend.

If income or bills change, update a few fields and Cobalance instantly re-anchors the forecast.

THE BILLS ACCOUNT

A few simple rules turn your per-paycheck number into a zero-stress system.

Cobalance gives each person a per-paycheck deposit for the bills account. Have your employer direct-deposit that amount into the bills account each paycheck.

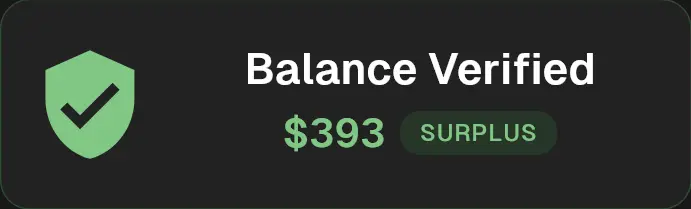

Cobalance lets you know if there's a shortfall in the forecasted balance. Stop the worrying and mental math to figure out if they're going to be covered.

Try to avoid unscheduled transactions against the bills account. This keeps the balance predictable. For shared, variable spending like groceries, consider opening another checking account. Once a week, transfer a fixed amount from bills to groceries.

GET STARTED

Set up your shared bills system in minutes.

Cancel anytime before your trial ends.